What Retirees Need to Know about the New Federal Pension Rules

Mark Miller / Reuters

Dec. 18, 2014

Only a small percentage of retirees are directly affected by the new rule.

But future legislation may lead to more pension cutbacks.

The last-minute deal to allow retiree pension benefit cuts as part of the federal spending bill for 2015 passed by Congress last week has set off shock waves in the U.S. retirement

Buried in the $1.1 trillion “Cromnibus” legislation signed this week by President Barack Obama was a provision that aims to head off a looming implosion of multiemployer pension plans—traditional defined benefit plans jointly funded by groups of employers. The pension reforms affect only retirees in struggling multiemployer pension plans, but any retiree living on a defined benefit pension could rightly wonder: Am I next

“Even people who aren’t impacted directly by this would have to ask themselves: If they’re doing that, what’s to stop them from doing it to me?” says Jeff Snyder, vice president of Cammack Retirement Group, a consulting and investment advisory firm that works with retirement plans.

The answer: plenty. Private sector pensions are governed by the Employee Retirement Income Security Act (ERISA), which prevents cuts for retirees in most cases. The new legislation doesn’t affect private sector workers in single-employer plans. Workers and retirees in public sector pension plans also are not affected by the law.

Here are answers to some of the key questions workers and retirees should be asking in the legislation’s wake.

Q: Cutting benefits for people who already are retired seems unfair. Why was this done?

A: Proponents argue it was better to preserve some pension benefit for workers in the most troubled plans rather than letting plans collapse. The multiemployer plans are backstopped by the Pension Benefit Guaranty Corp (PBGC), the federally sponsored agency that insures private sector pensions. The multiemployer fund was on track to run out of money within 10 years—a date that could be hastened if healthy companies withdraw from their plans. If the multiemployer backup system had been allowed to collapse, pensioners would have been left with no benefit.

Opponents, including AARP and the Pension Rights Center, argued that cutting benefits for current retirees was draconian and established a bad precedent.

Q: Who will be affected by the new law? If I have a traditional pension, should I worry?

A: Only pensioners in multiemployer plans are at risk, and even there, the risk is limited to retirees in “red zone” plans—those that are severely underfunded. Of the 10 million participants in multiemployer plans, perhaps 1 million will see some cuts. The new law also prohibits any cuts for beneficiaries over age 80, or who receive a disability pension.

Q: What will be the size of the cuts?

A: That is up to plan trustees. However, the maximum cuts permitted under the law are dramatic. Many retirees in these troubled plans were well-paid union workers who receive substantial pension benefits. For a retiree with 25 years of service and a $25,000 annual benefit, the maximum annual cut permitted under the law is $13,200, according to a cutback calculator at the Pension Rights Center’s website.

The cuts must be approved by a majority of all the active and retired workers in a plan (not just a majority of those who vote).

Q: How do I determine if I’m at risk?

A: Plan sponsors are required to send out an annual funding notice indicating the funding status of your program. Plans in the red zone must send workers a “critical status alert.” If you’re in doubt, Snyder suggests, “just call your retirement plan administrator,” Snyder says. “Simply ask, if you have cause for concern. Is your plan underfunded?”

The U.S. Department of Labor’s website maintains a list of plans on the critical list.

Q: How quickly would the cuts be made?

A: If a plan’s trustees decide to make cuts, a notice would be sent to workers. Snyder says implementation would take at least six months, and might require “a year or more.”

Q: Am I safe if I am in a single employer pension plan?

A: When the PBGC takes over a private sector single employer plan, about 85% of beneficiaries receive the full amount of their promised benefit. The maximum benefit paid by PBGC this year is $59,320.

Q: Does this law make it more likely that we’ll see efforts to cut other retiree benefits?

A: That will depend on the political climate in Washington, and in statehouses across the country. In a previous column I argued that the midterm elections results boost the odds of attacks on public sector pensions, Social Security and Medicare.

Sadly, the Cromnibus deal should serve as a warning that full pension benefits aren’t a sure thing anymore. So having a Plan B makes sense. “If you have a defined benefit pension, great,” Snyder says. “But you should still be putting money away to make sure you have something to rely on in the future.”

Tag Archives: Denverbrown blog

UPS Turns Parking Lots Into Sorting Centers to Add Speed

Outside a brick-and-mortar sorting facility in suburban Atlanta, UPS has built its own Christmas village.

It’s functional, if not festive: the company welded together aluminum segments and placed them atop a poured concrete floor to create a makeshift package-sorting facility in an employee parking lot. Inside, conveyor belts whisk packages toward the gaping delivery bays and awaiting delivery trucks.

These “mobile distribution center villages” deployed around the U.S. are designed to help avert a repeat of last year’s Christmas delays that saw thousands of gifts delivered a day or more late. United Parcel Service Inc. (UPS) is in crunch time. It expects six days this month to surpass its single-busiest shipping day of last year. Things should peak today with an estimated 34 million items dropped off at homes and businesses.

“It all goes back to 585 million packages in the month of December,” spokesman Dan Cardillo said. “It’s a lot more packages than we usually handle.”

The center in Roswell, Georgia, resembles a metal outdoor self-storage unit and even though it’s equipped with space heaters, a morning visit last week felt as chilly inside as the 28 degrees Fahrenheit (minus 2.2 degrees Celsius) outside.

The temporary structure means a 40 percent boost in capacity to process holiday gifts in surrounding ZIP codes for the world’s biggest delivery company.

Real Test

UPS has spent the past 12 months preparing for this. Memories of last year, when it missed some Christmas deadlines because of bad weather and a rush of last-minute online orders, are fresh. The company took an image beating and was forced to make $50 million in refunds because of missed deadlines. In response, UPS moved up its plans for $500 million in capital projects to accommodate this year’s peak season, and it dedicated another $175 million of operating expenses to it.

The moves are paying off as UPS navigates today’s crush of packages, said Andy McGowan, a spokesman for the company.

“While today will be UPS’s busiest day of the year, we expect packages to be delivered as planned,” he said. “All UPS air and ground operations are operating smoothly, demonstrating the value of the additional investments in capacity and technology.”

On-Time Rate

During the week of Dec. 7 to Dec. 13, UPS deliveries were on-time 95 percent of the time, according to package tracking company ShipMatrix Inc. That’s an improvement over the same week a year earlier, when UPS’s on-time rate was 92 percent.

“This year, because they’ve done planning, they are sustaining the service levels,” said Satish Jindel, a logistics consultant from Sewickley, Pennsylvania, and president of ShipMatrix.

UPS shares rose 0.9 percent to $112 at the close in New York. They gained 6.6 percent this year compared with a 12 percent increase in the Standard & Poor’s 500 Index.

The mobile villages are a piece of UPS’s strategy to make things right this year, along with hiring 95,000 seasonal workers to sort boxes and deliver packages. That exceeds the peak-season hiring done by Amazon.com Inc. (AMZN) and Macy’s Inc. UPS operated one mobile village last year, and rolled out another 14 across the country this year.

Early Start

In Roswell, 22 miles north of Atlanta, the 100 employees at the mobile village supplement the work done at a 225,000-square-foot (20,900-square-meter) permanent sorting facility next door. As many as 90 trucks a day pull into the delivery bays, awaiting fresh loads of tricycles, Christmas sweaters and electronics bound for Roswell and nearby Marietta. That adds to the 200 vehicles the regular processing center accommodates.

On a recent morning, village workers dressed in jackets, gloves and hoodies picked items off conveyor belts. A label affixed to each box tells employees which truck to load the box in and what shelf to put it on. Next-day items due at offices and homes by 10:30 a.m., go up front, less pressing deliveries go in back.

Work at UPS starts early, with some employees arriving at about 3:30 a.m., expected to load three trucks in a five-hour shift.

Cardillo, the spokesman, declined to give UPS’s startup cost for each mobile village.

‘Moved Anywhere’

“These temporary delivery centers provide us enormous flexibility,” Cardillo said by e-mail. “This not only includes during peak season, but any time of year. These MDCs can be moved anywhere around the country to set up temporary operations.”

In January, UPS will take down its aluminum panels and conveyor belts, leave the concrete foundation intact and it will return to a parking lot. Until then, employees are parking at a concert amphitheater nearby and shuttling to their jobs in school buses.

“We will be getting right back to work servicing customers we serve every day,” Cardillo said. “The peak holiday deliveries will be done, but the returns pick up right away.”

To contact the reporter on this story: Michael Sasso in Atlanta at msasso9@bloomberg.net

And The Next Hacker Attack Is?

IBT on possible pension cuts

IBT: We encourage everyone to remain calm

Tens of thousands of Teamsters and retirees voiced their strong opposition over the last weeks and months to pension legislation that was included in the Omnibus spending bill. Unfortunately, the legislation was sneaked into the bill literally in the dark of night and through procedural chicanery that didn’t even allow for a separate vote or give us the opportunity to strip the provisions from the bill and passed the Senate late Saturday evening. We encourage you to make one more call to the White House at 202-456-1414 to encourage President Obama to rethink his present course of action and veto it when it reaches his desk.

Over the next days and weeks, we will be providing more information on the timing of this legislation and what you can do to continue this fight. It is important to note that no pension cuts are going into effect immediately.

We understand that this is a very difficult time for all Teamsters, especially retired Teamsters who are dependent on their pension. We encourage everyone to remain calm while we continue our efforts to protect every member and their pension.

Please check out www.Teamster.org for the most up-to-date information that we know on the issue.

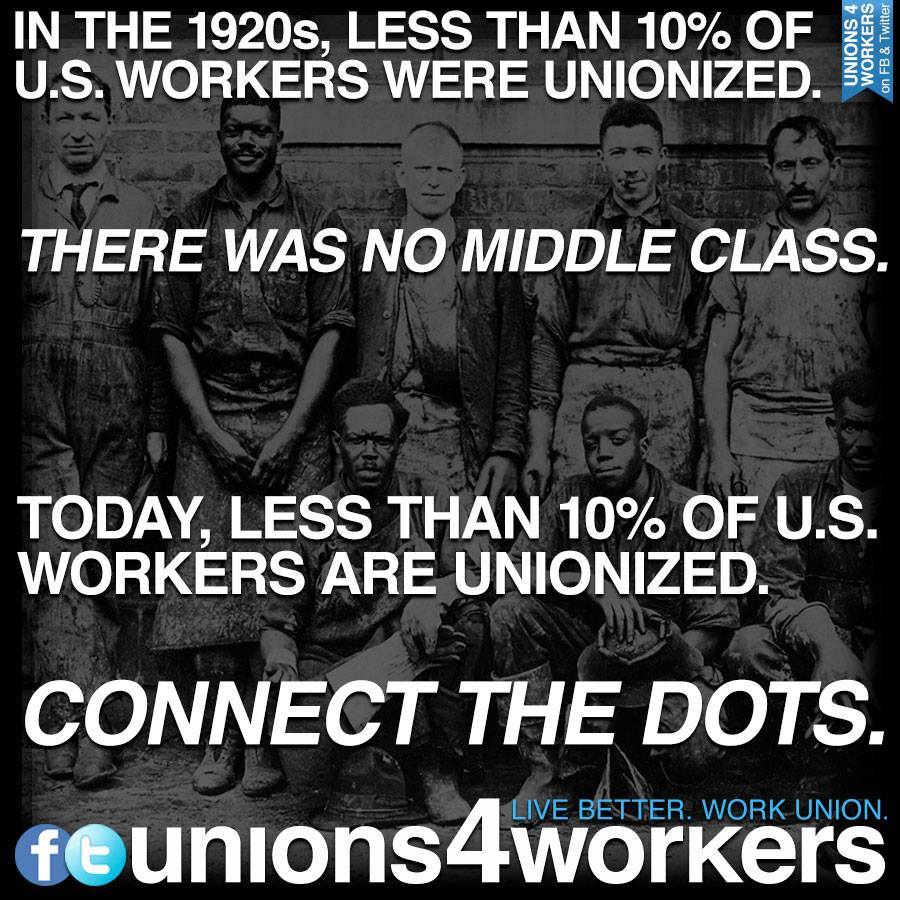

A Union Benefit

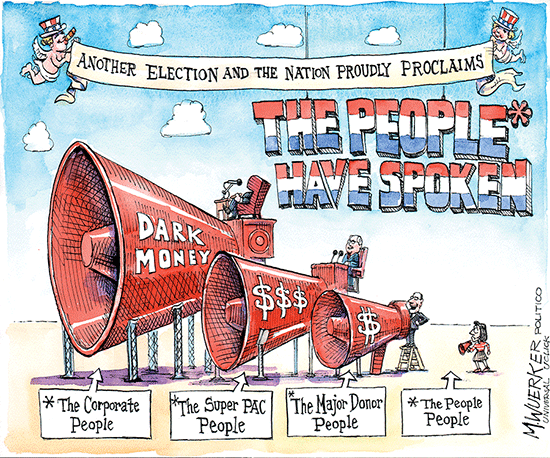

We the People………..

How stupid are we ??

“Faced with an onrushing manmade climate crisis, U.S. voters have now elected a congressional majority that denies global warming. (Did I mention that it’s also a majority financed by oil, gas, and coal money?) Burdened with a reverse Robin Hood tax structure that robs the poor to give to the rich, voters elected the people who are most adamant that the rich, the richer, and (most of all) the richest be taxed lightly (if at all) lest they cease creating jobs.”