Monthly Archives: April 2011

I Thought They Crushed All These

Saying for the Day

| |

|

|

Retirement

A Mercedes Benz Modell 600 at the Oldtimermarkt Bockhorn.

This van was formerly used by UPS in germany, chassis and engine are Mercedes Benz.

The coachwork was done by Kässbohrer.

Originally these vans have no Mercedes Benz emblems on them, they were added by the current private owner on this one.

Mechanicman

Rumor Has It

Sources say the company intends to retrofit all package cars with a new starting system. The driver will carry a FOB that enables the starting system to function. A push button on the dash allows the truck to start, but only when the FOB is in proximity. The FOB also enables the locking and unlocking of the bulkhead door, and the back door without having to use a key. When the driver moves a certain distance away, the truck should be secure. The cost of retrofit is rumored to be in the millions, and every vehicle is supposed to get one.

Sources say the company intends to retrofit all package cars with a new starting system. The driver will carry a FOB that enables the starting system to function. A push button on the dash allows the truck to start, but only when the FOB is in proximity. The FOB also enables the locking and unlocking of the bulkhead door, and the back door without having to use a key. When the driver moves a certain distance away, the truck should be secure. The cost of retrofit is rumored to be in the millions, and every vehicle is supposed to get one.

The plus is the elimination of the “key on the finger” delivery method. No putting the key in the ignition. No putting the key in the bulkhead door. Sources say the company expects to recover the cost of retrofitting it’s entire fleet the first year in time savings by changing driver methods. They also will benefit from increased security by drivers being unable to leave their keys in the truck.

The only real negative I can see is during severe cold weather, when the truck will not stay warm unless left running, the drivers will be freezing their asses off, because the truck will shut down when the FOB moves away from the vehicle. Of course I can see where drivers will leave the FOB in the truck while they make the delivery. A new terminating offense?

I love new Technology. Obviously so does the company.

Dog Training

What excuse does this guy give for a reason he is making a stop where there is no delivery. Telematics takes the humanity out of the job.

Quality Management!

If you’ve ever worked for a boss who reacts before getting the facts and thinking things through, you will love this!

If you’ve ever worked for a boss who reacts before getting the facts and thinking things through, you will love this!

Arcelor-Mittal Steel, feeling it was time for a shakeup, hired a new CEO. The new boss was determined to rid the company of all slackers.

On a tour of the facilities, the CEO noticed a guy leaning against a wall. The room was full of workers and he wanted to let them know that he meant business. He asked the guy, “How much money do you make a week?”

A little surprised, the young man looked at him and said, “I make $400 a week. Why?”

The CEO said, “Wait right here.” He walked back to his office, came back in two minutes, and handed the guy $1,600 in cash and said, “Here’s four weeks’ pay. Now GET OUT and don’t come back.”

Feeling pretty good about himself, the CEO looked around the room and asked, “Does anyone want to tell me what that goof-ball did here?”

From across the room a voice said, “Pizza delivery guy from Domino’s.”

Wisconsin Union People Continue to Turn Out

Union supporters outflank Sarah Palin’s tea party crowd in Wisconsin

Palin rally (Allen Fredrickson/Reuters)

John Nichols notes that Sarah Palin’s anti-union tea party rally was overwhelmed by union supporters on Saturday:

Madison’s ABC News affiliate reported that “pro-union labor supporters surrounded smaller groups of tea party members waiting for former Alaska Gov. Sarah Palin to appear outside the Wisconsin Capitol” while the NBC affiliate reported: “A solid core of tea partiers were near the stage, but they were flanked on all sides by union protesters who have dominated protests at the Capitol for months. The tea party folks had the microphone, but the crowd had the volume, literally and figuratively.” … When Palin got to the frontlines, she was greeted not with a warm embrace but with a throngs of Wisconsinites holding signs that read: “Grizzlies Are Not a Native Species,” “The Mad Hatter Called… He Wants His Tea Party Back,” “I Can See Stupid From My Condo” and “Wisconsin Loves Tina Fey!”—a reference to the comic who famously parodied Palin on NBC’s Saturday Night Live.

To be clear, there were Palinites present. What was surprising—in a state where the political climate is charged, and where there are genuine divisions—was that there were not more of them.

The New York Times reported that even even Scott Walker skipped the rally, adding that it was “uncertain” how many of the 6,500 in the crowd were actually supportive of Palin’s message. Whatever the exact numbers, the fact that the pro-union presence rivaled or even outnumbered those who showed up to support Palin’s teahadist message is yet another reminder that all the energy in this debate is on the progressive side.

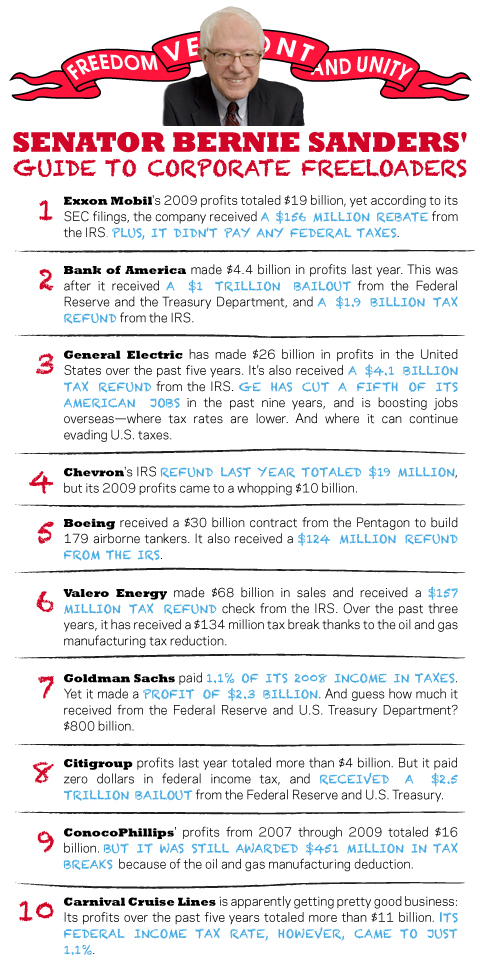

Corporate Thieves

Shared Sacrifice?

BURLINGTON, Vt., March 27 – While hard working Americans fill out their income tax returns this tax season, General Electric and other giant profitable corporations are avoiding U.S. taxes altogether.

With Congress returning to Capitol Hill on Monday to debate steep spending cuts, Sen. Bernie Sanders (I-Vt.) said the wealthiest Americans and most profitable corporations must do their share to help bring down our record-breaking deficit.

Sanders renewed his call for shared sacrifice after it was reported that General Electric and other major corporations paid no U.S. taxes after posting huge profits. Sanders said it is grossly unfair for congressional Republicans to propose major cuts to Head Start, Pell Grants, the Social Security Administration, nutrition grants for pregnant low-income women and the Environmental Protection Agency while ignoring the reality that some of the most profitable corporations pay nothing or almost nothing in federal income taxes.

Sanders compiled a list of some of some of the 10 worst corporate income tax avoiders.

1) Exxon Mobil made $19 billion in profits in 2009. Exxon not only paid no federal income taxes, it actually received a $156 million rebate from the IRS, according to its SEC filings. (Source: Exxon Mobil’s 2009 shareholder report filed with the SEC here.)

2) Bank of America received a $1.9 billion tax refund from the IRS last year, although it made $4.4 billion in profits and received a bailout from the Federal Reserve and the Treasury Department of nearly $1 trillion. (Source: Forbes.com here, ProPublica here and Treasury here.)

3) Over the past five years, while General Electric made $26 billion in profits in the United States, it received a $4.1 billion refund from the IRS. (Source: Citizens for Tax Justice here and The New York Times here. Note: despite rumors to the contrary, the Times has stood by its story.)

4) Chevron received a $19 million refund from the IRS last year after it made $10 billion in profits in 2009. (Source: See 2009 Chevron annual report here. Note 15 on page FS-46 of this report shows a U.S. federal income tax liability of $128 million, but that it was able to defer $147 million for a U.S. federal income tax liability of $-19 million)

5) Boeing, which received a $30 billion contract from the Pentagon to build 179 airborne tankers, got a $124 million refund from the IRS last year. . (Source: Paul Buchheit, professor, DePaul University, here and Citizens for Tax Justice here.)

6) Valero Energy, the 25th largest company in America with $68 billion in sales last year received a $157 million tax refund check from the IRS and, over the past three years, it received a $134 million tax break from the oil and gas manufacturing tax deduction. (Source: the company’s 2009 annual report, pg. 112, here.)

7) Goldman Sachs in 2008 only paid 1.1 percent of its income in taxes even though it earned a profit of $2.3 billion and received an almost $800 billion from the Federal Reserve and U.S. Treasury Department. (Source: Bloomberg News here, ProPublica here, Treasury Department here.)

8) Citigroup last year made more than $4 billion in profits but paid no federal income taxes. It received a $2.5 trillion bailout from the Federal Reserve and U.S. Treasury. (Source: Paul Buchheit, professor, DePaul University, here, ProPublica here, Treasury Department here.)

9) ConocoPhillips, the fifth largest oil company in the United States, made $16 billion in profits from 2006 through 2009, but received $451 million in tax breaks through the oil and gas manufacturing deduction. (Sources: Profits can be found here. The deduction can be found on the company’s 2010 SEC 10-K report to shareholders on 2009 finances, pg. 127, here)

10) Over the past five years, Carnival Cruise Lines made more than $11 billion in profits, but its federal income tax rate during those years was just 1.1 percent. (Source: The New York Times here)

Sanders has called for closing corporate tax loopholes and eliminating tax breaks for oil and gas companies. He also introduced legislation to impose a 5.4 percent surtax on millionaires that would yield up to $50 billion a year. The senator has said that spending cuts must be paired with new revenue so the federal budget is not balanced solely on the backs of working families.

“We have a deficit problem. It has to be addressed,” Sanders said, “but it cannot be addressed on the backs of the sick, the elderly, the poor, young people, the most vulnerable in this country. The wealthiest people and the largest corporations in this country have got to contribute. We’ve got to talk about shared sacrifice.”