Tag Archives: Denverbrown

I like this guy

For Your Next Party

Supe Working Grievance?

Dream On Mr. Reich Until “Citizens United” Is Repealed, No Change

Robert Reich

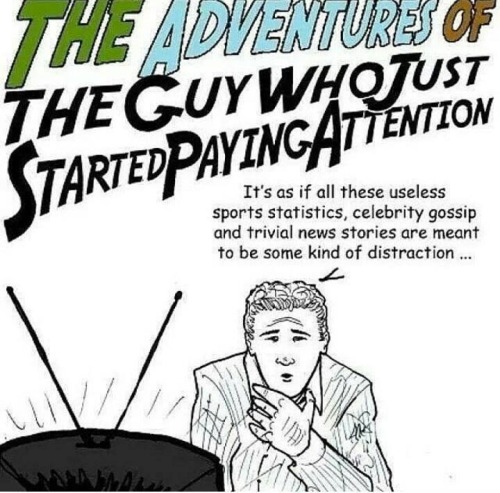

The Republican congress that takes over this week will try to drive a generational wedge through the electorate. They’re cooking up arguments that the nation can’t afford to provide our children adequate health care and education if we’re going to meet the demands of the baby-boomer elderly for Medicare and Social Security (thereby trying to justify cuts in all these programs even as they cut taxes on the wealthy and corporations). This is utter nonsense, for the following reasons:

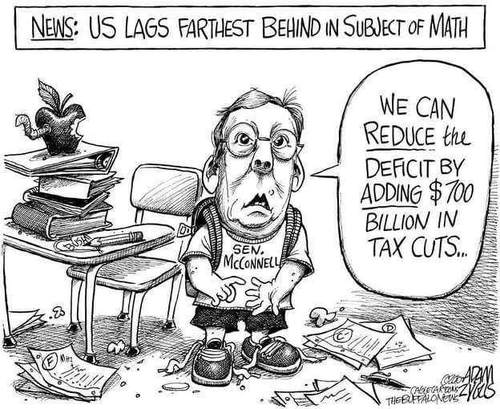

(1) Social Security’s pending shortfalls don’t begin for another 20 years, and they can be avoided entirely if the cap on income subject to Social Security payroll taxes (for 2015, $118,500) is lifted.

(2) Medicare’s costs are slowing, and they’d be even lower if the government allowed Medicare to use its bargaining power to negotiate lower prices from drug companies and other suppliers.

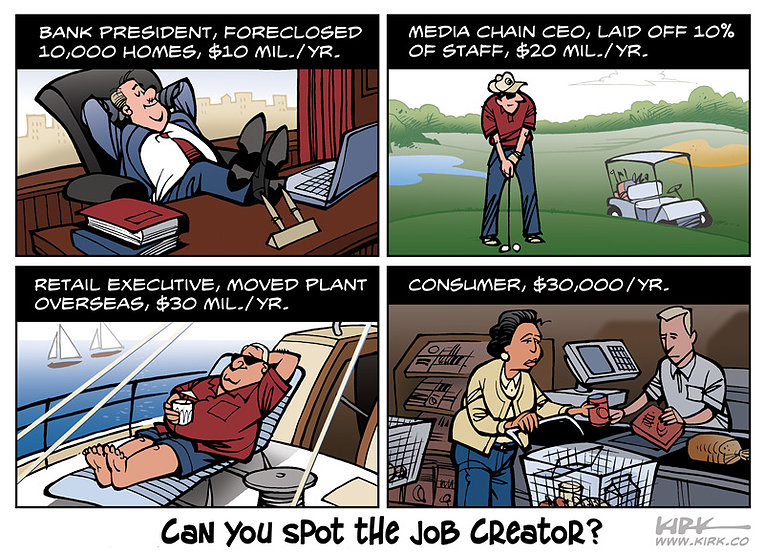

(3) The best way to assure there’s enough money for our childrens’ health care and education is to raise taxes on the wealthy, who have never been as rich. State and federal taxes on the wealthy now take a lower percentage of their income than at any time since the 1920s.

Don’t succumb to the Republican’s upcoming generational-divide tactics. The nation as a whole is wealthy enough to provide for both our children and our seniors in years to come, if the rich and corporations pay their fair shares.

Takes two

The new math

Hope for the New Year

Republican Pension Cuts and You

FAQs: What the Pension Bill Means for You

The ink is still drying on the pension cut deal that was attached in the dead of night to Congress’s spending bill. Some FAQs can be answered now; TDU will provide updated information as it becomes available

Does this bill mandate pension cuts?

No. This bill permits “deeply troubled” pension plans, those which could become insolvent over the next 10-20 years, to cut already-earned pensions of retirees and active workers. These cuts will be up to the trustees of the pension fund; the trustees are 50% union officials, and 50% management reps. No cuts will go into effect immediately.

Could this affect other Teamsters, or just those in the Central States Pension Fund?

Most Teamster funds will be completely unaffected. The Western Conference Fund is in the “green zone.” Other large Teamster funds, such as New England, Local 705, Local 710, Local 804, Local 177, Joint Council 83, and most others will be unaffected, even if they are in the “red zone.” For example, Local 804 just won significant pension benefit increases in their recent contract.

Certain deeply troubled small Teamster funds may be affected. New York Local 707’s pension fund is nearly insolvent, as freight jobs dried up, and their biggest employer YRC got concessions to drastically cut their contributions to all pension funds. So we expect the Local 707 Fund to consider pension cuts.

How will it affect Teamsters in the Central States Fund?

The Director of the Fund, Thomas Nyhan, was a principal lobbying force for this bill, and has stated that CSPF will impose cuts on retirees and active Teamsters. The Trustees of the fund, who are 50% management and 50% Teamster officials politically aligned with Hoffa, support the bill and support cutting pensions. They will make the decisions on when, who, and how much to cut, within the bounds of the new legislation.

Have Central States officials indicated how much they will cut?

In the past, Al Nelson, the Benefit Services Director of Central States, stated that a cut of about 30% would be what is needed.

But now the legislation has changed that. It requires that workers (so-called “orphans”) who retired from companies that went bankrupt (such as CF, Allied Systems, Preston, or Hostess, for example) be cut first and hardest.

This horrendous language is contained on page 81 of the pension legislation.

At this point, no one knows what the cuts will be, because we do not know how this legislation will be interpreted or applied. The next move will be by the Central States trustees.

The legislation also has protective language for some retirees: those over 80, those receiving only a disability pension, and to a partial degree, those who are 75-80.

How will this affect UPS retirees in the Central States Fund?

UPS bought enough influence in Congress to save an estimated $2 billion through a special interest loophole that shifts the company’s cost burdens on to Teamster retirees who will face additional pension cuts as a result.

On pages 81-82 of the pension legislation there is a loophole dedicated to exactly one corporation, UPS. This loophole means that CSPF will probably not be able to cut the pensions of UPS workers who retired after January 1, 2008, because they are “Priority 3” in order of cuts (the best priority).

UPS retirees do not benefit one cent from this loophole because their pensions are already protected by the contract. Article 34, Section 1 of the current UPS master agreement, requires UPS to make up the full pension to UPSers if CSPF imposes cuts.

UPS’s special interest loophole means the company won’t have to make up for any pension cuts. As a result, all non-UPS retirees will face $2 billion more in pension cuts. Retirees are footing the bill so that UPS doesn’t have to pay the obligations it agreed to in the contract.

It is not known if the “UPS Exemption” also covers UPS Teamsters who retired from Central States before January 1, 2008. These Teamster retirees deserve to know their status and if they may face pension cuts.

Will Teamsters and retirees get a vote prior to any cuts?

A ‘fact sheet’ issued by the bills sponsors claims that workers and retirees will get a vote before cuts could be made. But this is not true because of additional loopholes in the deal.

First, those in Central States can be deprived of a vote, because it is a large fund and its failure could seriously impact the Pension Benefit Guaranty Corporation (PBGC).

To add insult to injury: a majority of all participants – not just voters – would be required for a No result. In other words, not voting would count as a vote in favor of a pension cut!

If Central States makes these cuts, will the fund be secure?

Maybe. Certainly slashing the benefits would improve the bottom line. But in the long run a pension plan needs contributing employers, and here is where the Hoffa administration has failed badly. They severely undermined the Fund by letting UPS pull out 45,000 participants, and they have not organized new companies into the fund. Central States set up a special “hybrid” kind of plan to allow new companies to join the fund with zero withdrawal liability. It was designed for organizing. But it has not been used for new companies. That has to change.

Will Teamster officials and Central States officials have to take cuts?

That remains to be seen. Because their work for the fund or local unions will not count as “orphan” time, they may or may not face cuts. But Thomas Nyhan, the fund director, is paid $662,060, so he probably isn’t worried. Neither is Hoffa: he is in the lucrative Family Protection Plan, which pays far more than a working Teamster could dream of collecting.

Sign up for email updates at www.tdu.org and like us on facebook.

The Pension Rights Center’s backgrounder on the pension-cut bill

Retirees Listen UP

1.5 million pensioners may soon see benefit cuts

WASHINGTON – Retirees covered by financially troubled multiemployer pensions could soon see their benefits cut under a $1.1 trillion congressional spending deal to keep the government running.

Architects of the proposal said it was the best way to keep the pension plans viable and benefits flowing to retirees.

“We have a plan here that first and foremost works for the members of the unions, the workers in these companies and it works for the companies,” said Rep. George Miller, D-Calif., who worked the deal out with Rep. John Kline, R-Minn.

But it quickly drew fire from some labor unions and AARP, who denounced what they call backroom deal-making that will create hardships for older Americans.

A vote on the overall spending plan was expected before week’s end.

Here are some questions and answers about multiemployer pension plans and the impact of the congressional move.

___

What are multiemployer pension plans?

These plans are usually found in industries that have many small employers that would not ordinarily put together a pension plan on their own, according to a report from Boston College’s Center for Retirement Research.

More than 10 million people are covered by the plans, which involve agreements between labor unions and a group of companies. Many plans cover those who work in construction, but they are also can be found in the transportation, retail and trade sectors.

All told, there are about 1,400 multiemployer pension plans.

___

How did things get so bad?

About 150 to 200 of these plans covering 1.5 million people are in financial trouble and could become insolvent within a few years, according to estimates from the Pension Benefit Guaranty Corp. (PBGC). The agency was established by Congress to take over failed and failing pensions when they run out of money.

The plans were once thought to be secure, but a decline in unionization and financial crises like the Great Recession have left them with fewer workers to pay into them.

The PBGC says it’s about $42.4 billion short of the money it would need to pay out pensions for plans that have failed or will fail. That’s up from $8.3 billion in 2013.

The congressional proposal essentially shifts much of the risk from the government back onto the retirees and their funds.

Alicia H. Munnell, a Boston College professor and director of the school’s Center for Retirement Research, says that decision was made out of desperation.

“They’re at a point in time where it’s impossible to cut benefits for new employees any further,” she said. “It’s sort of impossible to ask employers for any more money, so the question is what do you do?

“It’s a place where there’s no good options.”

___

What kind of cuts are looming?

This can vary widely, depending in large part on the financial condition of the plan and the wages paid in the industry.

“We have plans where a 10 percent cut will be enough to allow them to survive and thrive,” said Randy DeFrehn, executive director of the National Coordinating Committee for Multiemployer Plans, an advocacy group that consulted with Congress on the legislation.

In other cases, reductions as high as 30 percent may be necessary.

Some cuts may eventually be restored. That depends on factors like the industry, the plan’s location and how much trouble it was in when the cuts were made.

“It’s a function of a lot of different things,” DeFrehn said.

People will know whether their plans face a cut because they will have to vote on the cuts.

___

What about other pension plans?

Single-employer pension plans are much more common, covering about 31 million workers and retirees in around 22,300 plans.

The PBGC said in June that it was “highly unlikely” that its single employer program would run out of funds in the next decade.

The improving economy, better market returns and an $869 million jump in income from legislative changes led to the improvement.

“It’s a well-functioning pension insurance program, it’s adequately funded, it’s in fine shape,” Munnell said.

The PBGC does not guarantee government pensions, and those were targeted for cuts in the Detroit bankruptcy case. But Munnell said her research shows states are “absolutely committed” to paying benefits.

“In the end, the cuts to pensions in Detroit were relatively modest,” she added.

___

What’s the reaction?

Among unions, it’s mixed.

The AFL-CIO’s Building and Construction Trades Department has been generally supportive. But the Teamsters and Machinist unions blasted the provision.

“Today, we have seen the ugly side of political backroom dealings as thousands of retirees may have their pensions threatened by proposed legislation that reportedly contains massive benefit cuts,” said Teamsters President James Hoffa.

Machinists International President Tom Buffenbarger said, “While there is a genuine retirement crisis in this country today, the solution must not be borne by retirees who worked hard and faithfully contributed to their pension plans and have no practical means to replace lost income.”

The AARP, which says it represents millions of retirement-age Americans, also attacked the agreement as a “secret, last-minute, closed-door deal between a group of companies, unions and Washington politicians to cut the retirement benefits that have been promised to them.”

Karen Friedman of the Pension Rights Center, a group that opposes the changes, called the move “outrageous. We think that Congress is sneaking through a provision that would torpedo the most sacred protections of the federal private pension law and will devastate retirees.”

CBSnews