Bloomberg

By Jesse Drucker

7 hours ago

Wal-Mart Stores Inc. owns more than $76 billion of assets through a web of units in offshore tax havens around the world, though you wouldn’t know it from reading the giant retailer’s annual report.

A new study has found Wal-Mart has at least 78 offshore subsidiaries and branches, more than 30 created since 2009 and none mentioned in U.S. securities filings. Overseas operations have helped the company cut more than $3.5 billion off its income tax bills in the past six years, its annual reports show.

The study, researched by the United Food & Commercial Workers International Union and published Wednesday in a report by Americans for Tax Fairness, found 90 percent of Wal-Mart’s overseas assets are owned by subsidiaries in Luxembourg and the Netherlands, two of the most popular corporate tax havens.

Units in Luxembourg — where the company has no stores — reported $1.3 billion in profits between 2010 and 2013 and paid tax at a rate of less than 1 percent, according to the report.

All of Wal-Mart’s roughly 3,500 stores in China, Central America, the U.K., Brazil, Japan, South Africa and Chile appear to be owned through units in tax havens such as the British Virgin Islands, Curacao and Luxembourg, according to the report from the advocacy group. The union conducted its research using publicly available documents filed in various countries by Wal-Mart and its subsidiaries.

Randy Hargrove, a Wal-Mart spokesman, called the report incomplete and “designed to mislead” by its union authors. He said the company has “processes in place to comply with applicable SEC and IRS rules, as well as the tax laws of each country where we operate.”

Mailbox Subsidiaries

The union behind the study backs the Organization United for Respect at Wal-Mart, a group that campaigns for wage increases and more predictable schedules. Wal-Mart has historically resisted unions and discourages employees from joining them.

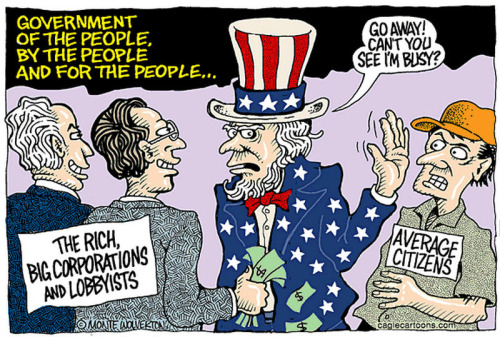

The report comes a week after the Group of Twenty nations unveiled its latest effort to combat multinational corporate tax avoidance. The body wants companies to disclose to regulators where they book profits, employees and sales, so tax authorities can be aware of discrepancies between where corporations report income and where they have operations.

Hargrove, the Wal-Mart spokesman, pointed to guidance issued by the SEC that permits companies to avoid disclosure of subsidiaries with significant “intercompany transactions.” He said Wal-Mart’s tax savings overseas was driven by lower rates in markets including Canada and the U.K.

‘Continuing Evidence’

Companies such as Google Inc., Apple Inc. and Starbucks Corp. have come under fire for avoiding billions of dollars of income taxes by attributing profits to mailbox subsidiaries in low-tax jurisdictions like Bermuda. The Group of Twenty has directed the Organization for Economic Cooperation and Development to develop plans to crack down on such strategies.

The new Wal-Mart disclosures could expand the scope of international tax reform, which has often focused on technology companies that move profits offshore by assigning valuable patent rights to mailbox units. Bloomberg News reported last year that Inditex SA, the parent of Zara, the world’s biggest fashion retailer, cut its taxes by shifting billions of dollars of profits to a tiny Dutch unit.

“This report is continuing evidence that everybody has been engaging in cross-border tax avoidance,” said Stephen E. Shay, a professor at Harvard Law School and former deputy assistant secretary for international tax affairs for the Obama Treasury Department.

Hybrid-Loan Strategy

Nearly a decade ago, Wal-Mart ran into trouble over strategies to avoid U.S. state income taxes. It used a real estate investment trust to effectively pay rent to itself, generating big tax deductions, even though the rent payments never left the company. At least six states changed their tax laws after publicity about the tactics.

Since then, Wal-Mart has stepped up its use of offshore tax havens. It has created 20 new subsidiaries in Luxembourg alone since 2009, according to the report.

Wal-Mart employs a popular legal strategy in that country called a hybrid loan. It permits companies’ offshore units to take tax deductions for interest paid — typically on paper only — to their parents in the U.S. The parent, however, doesn’t include that interest as taxable income in the U.S.

The OECD has called for an end to the tax benefits of such loans. Luxembourg generated headlines last year after the International Consortium of Investigative Journalists revealed its role in cutting the tax bills of hundreds of multinationals.

Union Funding

U.S. companies owe tax at a rate of 35 percent but can defer indefinitely the income taxes on profits attributed to overseas units. In 2011, Wal-Mart’s then-chief executive officer, Mike Duke, called in testimony before Congress for a system that would exempt from U.S. income tax the earnings that multinationals generate overseas.

Wal-Mart’s accumulated offshore earnings have doubled to $23.3 billion in 2015 from $10.7 billion 2008. The company operates about 6,300 stores in 27 countries outside the U.S. and last fiscal year reported 28 percent of its sales abroad, or about $137 billion.

Wal-Mart paid $6.2 billion in U.S. income tax last year, Hargrove, the company spokesman, said, or “nearly 2 percent of all corporate income tax collected by the U.S. Treasury.”

Americans for Tax Fairness called on the European Union to open investigations into whether the Luxembourg tax benefits constitute illegal state aid. The EU has issued preliminary findings that this was indeed the case with companies using similar strategies in various countries, including as Starbucks in the Netherlands, Apple in Ireland and Fiat SpA in Luxembourg.

The tax group receives most of its funding from foundations, including the Ford Foundation, Open Society Foundations, Bauman Foundations and Stoneman Family Foundation. It’s also funded by public-sector unions, including the American Federation of State, County and Municipal Employees and the National Education Association.