Category Archives: UPS

Retirees better listen up

Dear Retiree,

As I write this Teamster retirees from across the Midwest and South are marching in Chicago to defend workers’ pensions.

They’re rallying at a meeting called by the Central States Pension Fund to brief Teamster officials on plans to cut retiree benefits.

Can you make a one-time contribution today to support actions like this to protect our pensions?

“We’re here today because we worked hard, sometimes gave up raises, to earn a decent pension,” said Greg Smith, from Akron Ohio.

Teamsters like Greg are the life-blood of the growing movement to defend our pensions—and TDU has their back.

TDU Organizer Peter Landon is on the ground today in Chicago helping to organize the rally. TDU has been working with pension committees in various states and providing the logistics for today’s rally.

TDU is going to continue to press the fight to defend pensions.

We’re going to keep making noise and making sure Teamster voices are heard from the Central States Pension Fund to Washington, DC—along with our allies at the Pension Rights Center, AARP and other unions.

In solidarity,

Ken Paff

Common Sense

The good old days

Uniform options

New Uniform Option?

It ain’t over til it’s over

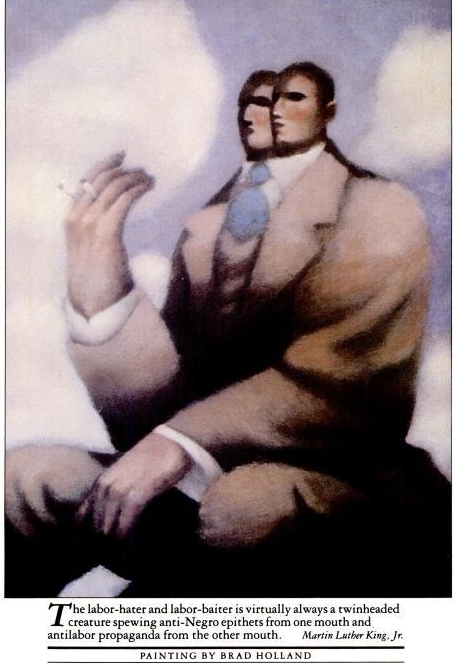

Logic is a sin

Can They Grab Your Pension?

Clawbacks become more common as plans discover they overpaid recipients

by Carole Fleck, AARP Bulletin, March 2015

Millions Could See Cuts

Tucked into the massive budget bill passed by Congress in December was a provision permitting certain financially troubled multiemployer pension plans to cut existing benefits potentially to hundreds of thousands of retirees who are under age 80.

Shifting burden

That 11th-hour provision toppled 40 years of protections for retirees already receiving benefits and may alter the course of the U.S. retirement system, retirement advocates say. “Congress has placed the burden of rescuing underfunded multiemployer plans on the people who can least afford it — retirees and surviving spouses who rely on their pensions for food, medication and other necessities,” says Karen Friedman, executive vice president at the Pension Rights Center in Washington, which fought against the legislation along with AARP and other groups.

Multiemployer plans — there are about 1,400 in the U.S. — are group pensions that several companies within a single or related industry pay into, mostly to cover union workers. But shrinking union membership, market declines and other issues have put some 150 to 200 plans — covering about 1.5 million people — in peril.

Out of money

Those plans could run out of money within 20 years, according to the Pension Benefit Guaranty Corp., which insures private pensions up to certain limits when employer plans go bankrupt. Retirees won’t see immediate cuts to their pensions because it’s a complex process to modify benefits.

Vote on cuts

For example, plans with at least 10,000 workers and retirees must permit all participants to vote on cuts before they’re implemented. Even if a majority oppose it, the Treasury secretary could override the vote and uphold trustees’ decisions to reduce payouts, in order to prevent insolvency. Under the provision, retirees ages 75 to 79 likely will see smaller cuts than those 74 and under. Pensioners in single-employer plans won’t be affected.