The days of guaranteed retirement benefit in the form of a pension are long gone. As numbers out of the Bureau of Labor Statistics show – defined benefit retirement pension are on a drastic decline since 1981. That was the year when over 80% of full-time workers in the private sector participated in a pension plan. By 1997, that number had plummeted to just over 50%. And by 2011, looking at all workers in all private businesses in America, fewer than 20% of workers have some sort of pension retirement plan. This translates into economic insecurity for seniors – especially now that Republicans in the House are trying to turn Social Security and Medicare over to private sector profiteers. This also adds to the growing list of things that Corporate America is taking from their workers, in its quest for higher and higher profits. In recent months – we’ve seen employers promise to reduce hours to avoid providing health insurance, we’ve seen the right to free political speech taken away, guaranteed vacation time and maternity leave don’t exist – workplace safety laws are getting watered down – heck, they’ve even taken our money by flattening our wages during a time of increased productivity. In some states, they even want to take away our bathroom breaks! This is nothing short of theft. And pretty soon, we’ll be handing over the shirts on our backs, just so that our bosses can squeeze whatever profits they can out of them.

Thom Hartmann

Category Archives: Retirement

Having fun at home

What PEAK means in Colorado

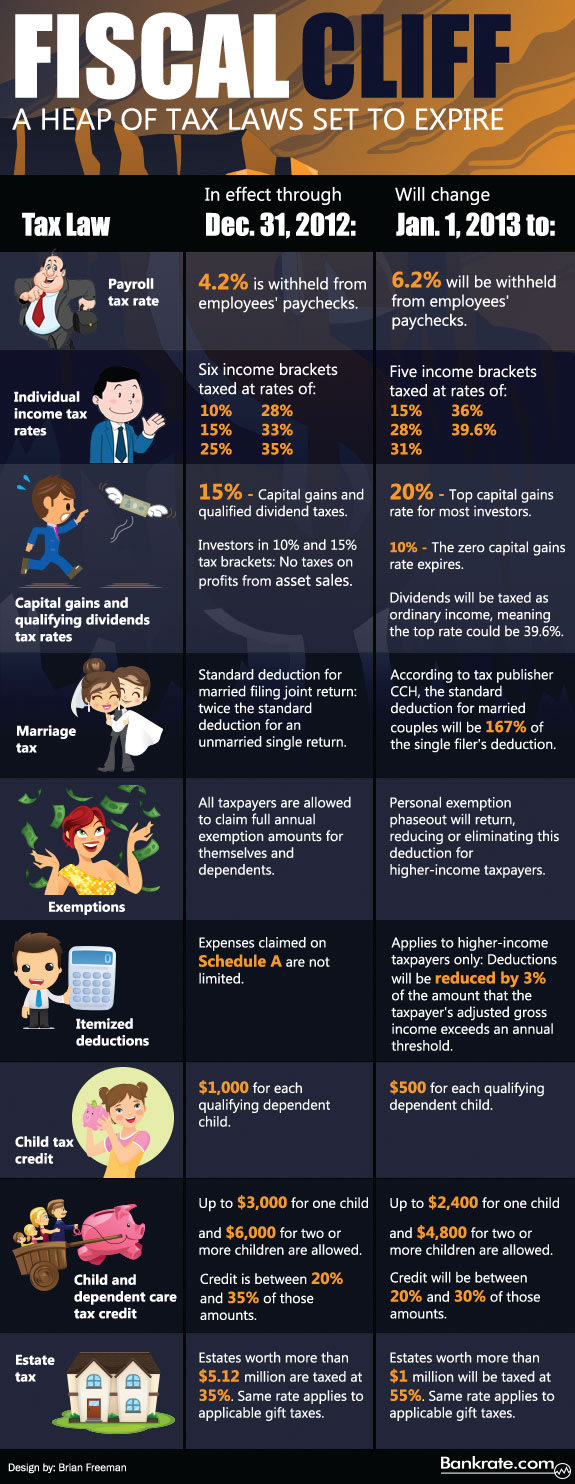

The Fiscal Cliff

A Link to the Current Proposals by the Teamsters to the Company

Proposed Contract submitted by the Teamsters for the 2013 Contract.

The UPS/IBT Pension Plan and Contract Negotiations 2013

Here is a discussion of the guarantee for benefits posted by George in 2009. The guarantee applies to drivers that retire prior to the 2013 contract.

While it is assumed that the guarantee will continue under the newly negotiated contract, that assumption is not for sure.

Any of you drivers that will not retire prior to August 2013 better be on the phone to your Local Union Officers to make sure that the National Negotiating committee has this discussion with the company. If the guarantee is not continued, many of you may be subject to pension benefit decreases with the failure of the Central States Pension Fund.

Please note that the CSPF is not failing, but due to federal law, they have been forced to reduce benefits to maintain solvency. Posted by Bob Sep. 2012

When UPS set up the UPS/IBT Full Time Pension Plan for employees covered by the Central States Plan (CS), it covered active employees only. You have to work at least one day after Jan 1. 2008 to go with UPS out of CS and into the new UPS/IBT Plan. People who retired before Jan 1, 2008, or for any reason were not able to work one day after that date remain in the Central States Plan.

So for retirees who voted for the new Pension Plan and will retire under the new Plan, it’s a pretty good deal. It guarantees a full pension for life. But what about oour brothers and sisters who retired prior to Jan. 1, 2008? They stay with CS and have no guarantees.

Should we have stayed with Central States and rejected the UPS offer?

Did UPSers sell out their own UPS brothers and sisters who retired prior to 2008? There was surely no reason to hang with the ailing Central States other than Brotherhood.

Granted, Brotherhood is a noble cause. It’s the very foundation of unionism.

But at what price??

Baby boomers find retirement age now a moving target

TDU Asks the Big Question

August 22, 2012: It’s an ugly question, but one that has to be faced. And then our union needs to take action to deal with the problem, to prevent it from happening.

Could the Central States Pension Fund Go Insolvent?

The Hoffa administration has all but given up on the Central States Pension Plan. This decision could have dire consequences for 280,000 Teamsters and retirees, numerous Teamster officers, and the financial viability of hundreds of Teamster locals.

What can be done to prevent this train wreck for Teamster pensions and Teamster power?

The key turning point came in late 2007 when James Hoffa and Ken Hall gave UPS management their long-sought concession: pulling out 44,000 full-time Teamsters—and said good-bye to the $800 million (and growing) that UPS would be contributing annually.

This sell-out set off a cascade of events. Other companies pulled out; added withdrawal liability to YRCW’s balance sheet; and a ratio of retirees to actives which is now over 3:1. Then the stock market, which the fund became heavily dependent on, took a tumble.

It gave UPS workers some short-term security, but now their pensions are in the hands of the company for decades to come. It also endangered the local unions that UPS workers belong to.

In late August, Hostess Brands Teamsters are voting on a proposed national contract which would pull thousands of more Teamsters out of the Central States Fund (and other Teamster pension plans). Hostess is in bankruptcy.

The 2011 Financial and Analytical Reports for the fund show that it ended the year with $17.7 billion, down $2.2 billion in a year. The fund depends on investment returns to pay benefits, and now must earn 12 percent a year on investments to tread water. This is not viable.

Fund Director Thomas Nyhan testified two years ago before Congress that the fund could be insolvent in a decade, without a lifeline of relief.

The Consequences

Over 213,000 retirees depend on the fund for their promised retirement after a lifetime of Teamster work. Another 67,000 active members have been promised a pension in the future.

If the fund becomes insolvent, Teamsters would be dependent on the Pension Benefit Guaranty Corporation (PBGC), which has a maximum payout per month of $1,080 for a Teamster with 30 years credit.

That tells you how devastating this would be.

Officers and Local Unions

Among the biggest losers would be Teamster local officers and business agents throughout the Central and Southern Regions and the Carolinas. Most of them retire with high seniority and a good pension.

For most of them, Central States provides their only pension, and it stands to be slashed to about $1,000 per month. (Officials in the South have an additional, officers-only pension plan.)

And if the fund fails, who then will want to become a union officer? The local unions cannot leave the Central States Plan, because the withdrawal liability payment would break them financially.

Our local unions would then be financially burdened and weakened.

Incredibly, most of these officers campaigned last year for James Hoffa and Ken Hall, the architects of the disaster in their own pension plan.

Concerned Teamsters need to stand up and speak out. It’s not too late to save our pensions and union but the clock is ticking.

The International Union needs to take a firm stand that no more corporations will be allowed to pull out. Hoffa has done the opposite, and in fact just bargained the National Pipeline Agreement to allow more companies out of Central States.

In addition, we need a political movement to save pensions in this country, initiated by the Teamsters but with a broad coalition of support. That won’t happen in this election year, but its time to start laying the basis for it.

Two years ago Senator Robert Casey of Pennsylvania sponsored a bill to help protect pension plans, and strengthen the PBGC and increase its guarantees. It had some bipartisan support, and was announced at the YRC terminal in Carlisle, Pa.

There was talk among Teamster members and officers about a march on Washington and building a broad coalition in defense of pensions. Members and retirees responded very favorably to this kind of action. The Hoffa administration poured cold water on it, in favor of lobbying politicians behind the scenes.

It’s time to put protection of pensions front and center on the Teamster agenda and on the national political agenda.

Potential for Change With Contract Negotiations

The 2013 Contract Negotiations will begin in ernest this fall. There is much speculation what will, and will not,

A corporate supportive government will empower the company to stand firm against the Union because they know that the support in a potential strike would be behind the company, allowing for replacement workers, and the potential for the company to be allowed to work without a contract, weakening the Union’s position in the negotiations.

Keep these things in mind when you vote this fall. Your job situation may depend on the outcome.

Some of the points of discussion are as follows;

Many of you may not understand that the company puts a dollar amount on the table. That dollar amount encompasses not only wages, but includes the cost of your healthcare, and your pension contributions. Putting more money into one category means taking out of another.

The speculation now is that most of the increases in the economic package will go to the benefits end. Healthcare costs have risen to the point where they eat up most of any increases in the economic package. That leaves very little to go to wage increases. The common wisdom is that most UPS drivers are being paid above the industry norm, so rather than increase wages noticeably, the increases will be put into benefits to minimize the out of pocket costs to the individual worker.

The expectation would be that wage scales will remain fairly flat for the term of the next contract.

For the part timers, proposals have been made to keep the wage rate at least 3 dollars an hour above the federal minimum wage level. Also changes in the benefit package could come again to part timers, as a cost savings to the company for healthcare. The reason part timers keep getting beat up in negotiations is because it’s common knowledge that they simply don’t vote. They are also very transient, and most of the parts timers here today, will not be here tomorrow.

As far as the general working language is concerned the usual major concern is over nine-fives, and lunchbreak times. Our contract is considered a mature contract. The remedies for nine-fives has been discussed over and over on every level. The fact is, drivers have the ability to have their hours reduced, if they put forth the effort. We could go into a discussion here about the drivers responsibility to bring things to management’s attention, and not be afraid to file, but we’ll save that discussion for later.

There is a push to get the driver’s lunchbreak reduced to a half hour from one hour it is now. Drivers seem to have the delusional thought that if their break was only a half hour, they’d get off a half hour earlier. We all know the reality is that the company would simply fill up that time with more work, keeping the driver from getting home any sooner. My feeling is we won’t see any change in that department.

I’m sure there will be discussions on present, and future technological changes and how they affect the driver’s day. Hopefully the contract will join the 20th century in dealing with the disciplinary issues that result from todays delivery process. In thirty some years it never did, and my expectations are low that there will be much change here.

Retirees major concern will be the cost of the retiree’s healthcare. Retiree’s currently pay $200 per month for their healthcare per person. That could change in the next negotiation. Obviously an increase would be devastating to retiree’s on a fixed income. I have no speculation as to what will happen here, I just hope the retiree’s don’t take it you know where.

The other issue at stake for future retiree’s (those that retire after August 1st, 2013), will be the UPS guarantee of the pension benefit amount in conjunction with the Central States Pension fund. Since the UPS removal of drivers from the Central States Pension Fund the fund has struggled to maintain benefit levels. The drivers that have retired under the current agreement have a guarantee from the company that benefit levels will remain the same regardless of what happens to the Central States Fund. In the 2013 negotiations, that guarantee is not automatically renewed, so if it isn’t, future retiree’s could be subject to reductions in their pension payments if the funding levels of Central States are reduced.

These are just a few of the issues at stake. Like usual there is a certain amount of apathy and what I call the UPS attitude, “Let someone else take care of it, I have more important things to worry about”. Most drivers couldn’t tell you what they have today, much less what any changes would mean to them. Of course they are the first ones to bitch about the strength of the Union. But that’s also a discussion for another day.

The hope is the contract will be decided early so it’s imperative that you all make your wishes known through your Local Unions as soon as possible. Sit down with your significant others and discuss things that may be important to you.

Also, each and every one of you needs to look carefully at what you are voting for in the upcoming elections. Are those candidates supporting your issues? Do those candidates understand what it’s like to be in your situation? Am I helping myself, and my fellow Teamsters when I pull the pin on the voting machine?

Make wise, and educated decisions. Don’t vote out of ignorance.